Enhancing risk mitigation strategies and providing insurance solutions through predictive analytics.

We provide satellite data for predictive analytics and risk assessment for insurance by unlocking insights for you to make informed choices.

In the Finance & Insurance sector, several challenges persist, ranging from the intricacies of behavioral analytics and profiling to the critical areas of fraud detection and prevention. Traditional methods frequently prove inadequate in accurately assessing risks and underwriting policies, leading to suboptimal outcomes. Moreover, the industry’s reliance on retrospective data for risk modeling and customer insights hinders real-time adaptability.

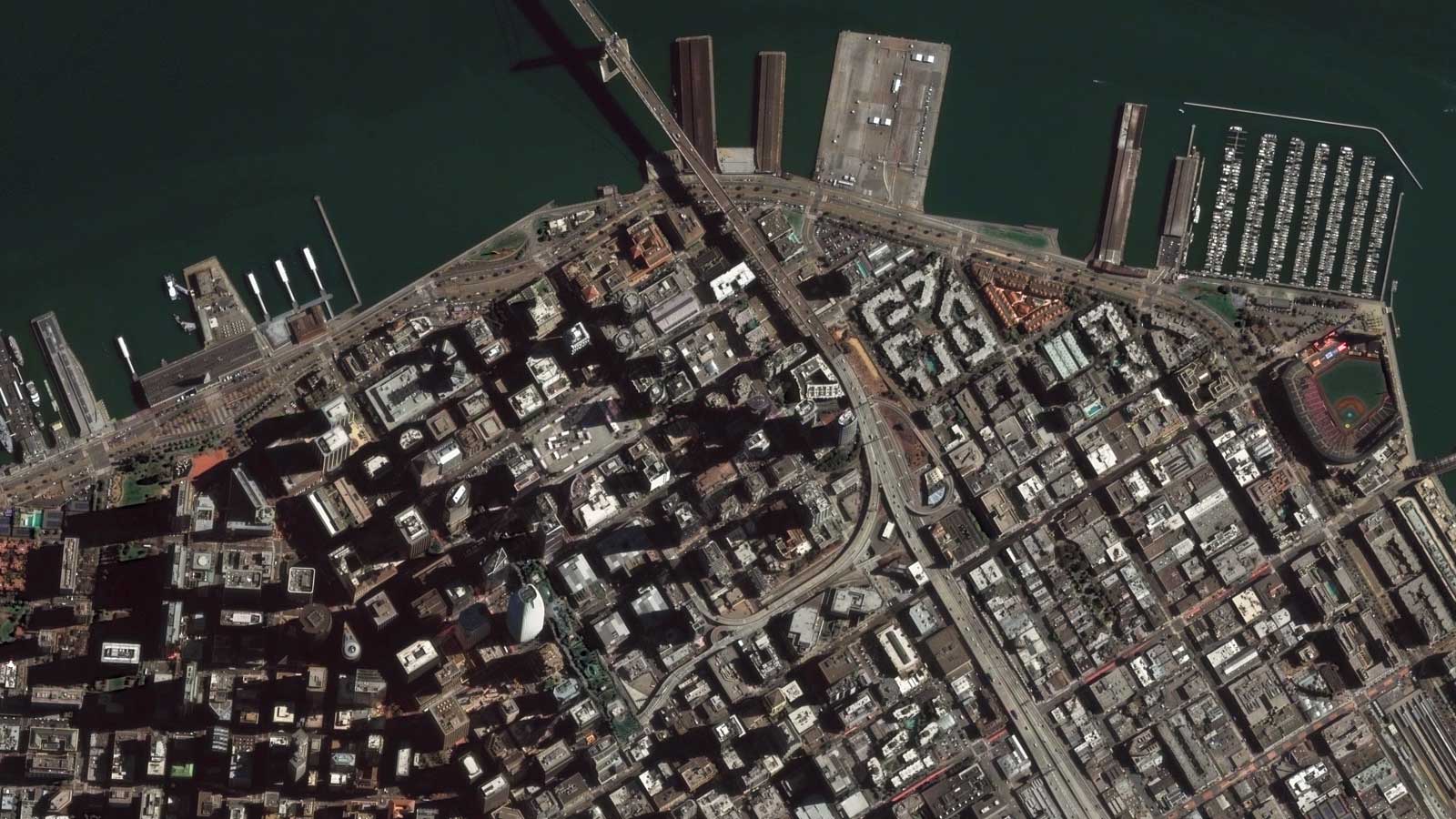

GEOSAT’s satellite data act as a crucial global risk assessment tool offering a transformative solution by providing comprehensive change detection and analysis capabilities, facilitating a proactive approach to risk assessment insurance, and helping in fraud prevention, property and damage assessment. Our ability to deliver timely high and very-high-resolution (VHR) imagery enables the identification of behavioral patterns and changes in near real-time, empowering insurers with predictive risk modeling insights and dynamic customer profiling while potentially improving policyholder coverage accuracy, ultimately leading to more secure policies and better premiums for policyholders.

Our unique capacity on predictive analytics insurance offers extensive coverage and consistent updates creates a paradigm shift in how the Finance & Insurance sector addresses these complex challenges, offering unprecedented accuracy and agility in decision-making processes.

Predictive insurance analytics main capabilities

By providing global access to up-to-date very high-resolution imagery with unprecedented coverage, we offer an unparalleled catalog with 10+ years of archive.

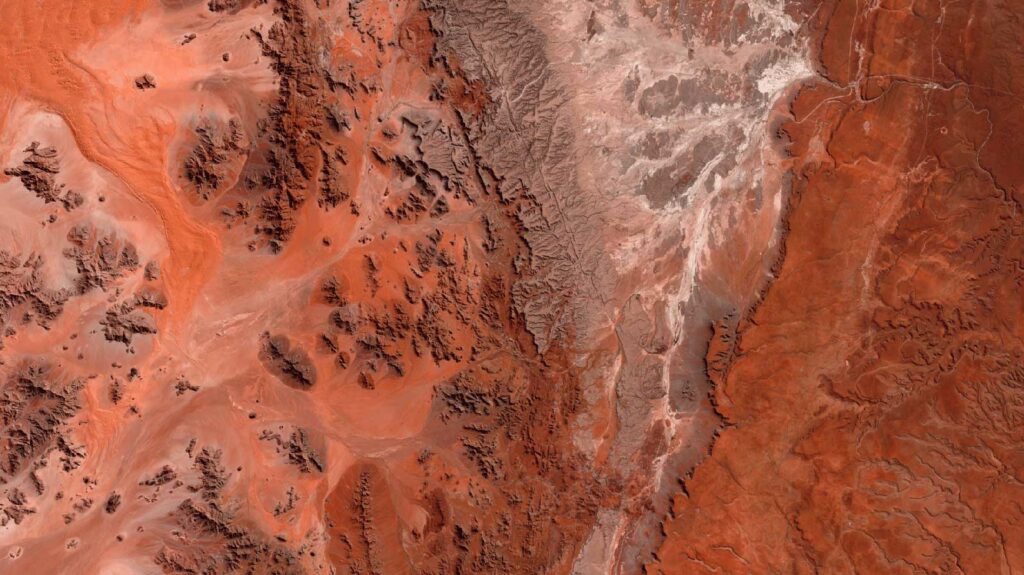

We provide diverse spectral information, such as vegetation health, natural disaster maps, moisture levels, or structural integrity, and enhance risk modeling for both policyholders and insurers across various environmental and geographical factors with greater precision and detail.

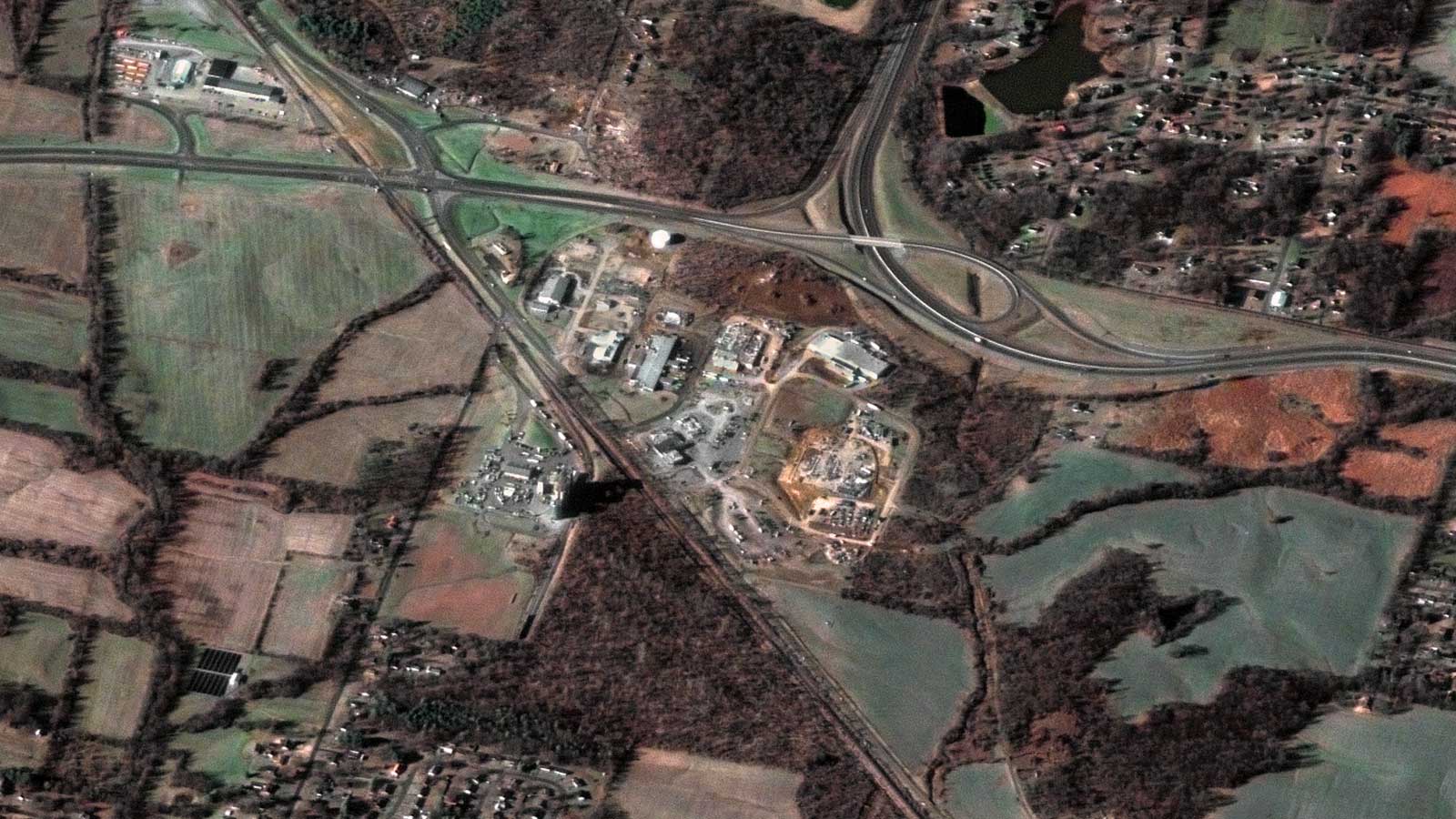

With wide-ranging coverage, we enable the monitoring and analysis of vast land areas, including remote or hard-to-access regions. We help you evaluate agricultural risk coverage.

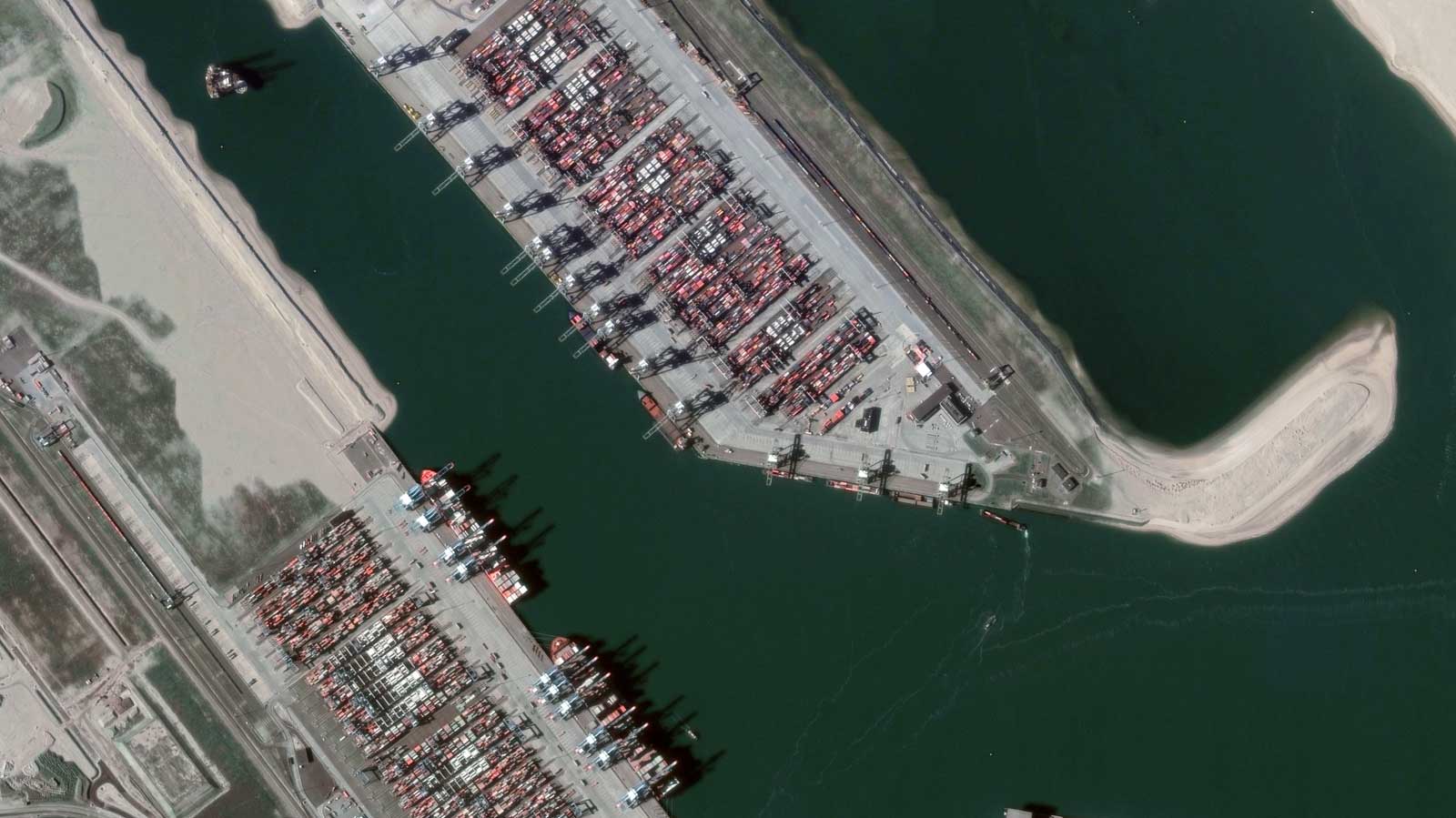

We analyze historical changes and promptly identify alterations in properties or environments, assess risks, update policyholder coverage accurately, and mitigate potential losses due to changes in different conditions.

Automatically recognizing and analyzing specific objects or characteristics within imagery, facilitating quicker risk and property assessment. More accurate underwriting decisions, and faster claims processing for policyholders based on identified features.

Thanks to our own satellites, together with our partners, we deliver high quality imagery and analytics for high impact insights which result in improved decision making.

Market samples

We work to build and deliver customized solutions in a large variety of applications and industries.

Benefits on satellite predictive analytics for Insurance and finance markets

We provide extensive coverage, frequent updates, detailed analysis, and improved predictive analytics for insurance, leading to more accurate assessments and proactive risk management.

Our rapid imaging and advanced analytics quickly analyze affected areas through change detection, helping to map infrastructure damage, assess environmental impact, and optimize resource allocation.

We offer continuous, wide-area coverage, enabling near real-time tracking contributing to risk mitigation strategies, and improved decision-making on asset conditions and performance.

We provide accurate near real-time information on specific events or conditions (such as weather patterns, natural disasters, or environmental impact), enabling the objective measurement of triggers, facilitating faster and more precise payouts to policyholders.

Our satellite data helps you improve risk assessment accuracy, enhanced supply chain monitoring, proactive identification of potential disruptions, and better decision-making, leading to increased efficiency, reduced risks, and improved overall profitability.

Embark on a journey with GEOSAT

GEOSAT is a unique solution in the Finance and Insurance sector thanks to our unparalleled integration of cutting-edge satellite data technology. Our offer revolutionizes risk modeling assessment and underwriting accuracy, benefiting policyholders by ensuring more tailored and precise coverage.

With our advanced analytics and VHR imagery, policyholders receive the advantage of timely and accurate assessments of property conditions, leading to more transparent and fairer premiums. On the other side, our data provides precise behavioral analytics, both in near real-time and over time, facilitating fraud detection and risk modeling assessment, granting insurers invaluable insights for enhanced decision-making. We empower your institution with the ability to adapt swiftly to changing conditions, optimize pricing strategies and risk mitigation, ultimately ensuring greater customer satisfaction and profitability. As industry leaders in leveraging satellite data, our insurance analytics solutions redefine the landscape of Finance and Insurance by delivering unmatched precision, agility, and foresight, making us your definitive partner for achieving unprecedented success in this sector.